The New Year has arrived, and if you aren’t crunching away in the gym, you’re at a desk crunching tax numbers in preparation for 2015 filings. Like all business owners, financial managers in the manufacturing industry need to be aware of beneficial tax code changes. Keep these federal tax laws in mind as your CNC and manufacturing business prepares 2015 taxes and plans for future purchases:

Section 179 Expensing

For 2015 the Federal Section 179 deduction has been restored to $500,000.

Section 179 of the tax code allows small business to immediately deduct up to half million dollars of qualified capital on the purchase of new or used equipment. The number had dropped back to a mere $25,000 a year.

The tax incentive is retroactive to January 1, 2015 and has been made a permanent deduction. To be eligible the purchase cannot exceed $2 million dollars. On purchases over $2 million, the deduction is phased out dollar for dollar up to $2.5 million.

Bonus Depreciation

Could there really be a tax bill bonus from the federal government? You better believe it! In addition to the $500,000 of deductions for Section 179 Expensing, manufacturing industry businesses can take 50% bonus depreciation on new equipment that was purchased and placed into service by 12/31 of the same year it was purchased, or the bonus depreciation will flow through to the following year’s tax return. The 50% bonus depreciation is good for the 2015, 2016 and 2017 tax years.

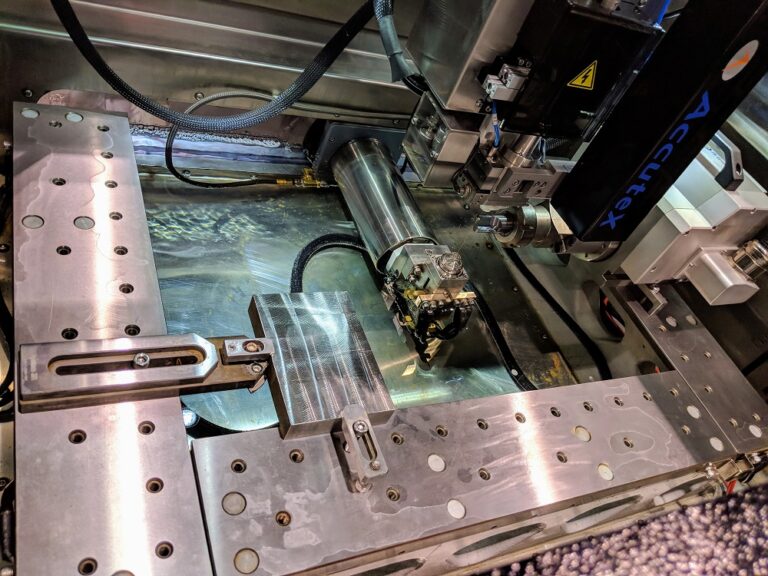

Those new Boring Mills, EDM Machines and Lathes from Absolute Machine all qualify for 50% bonus depreciation. Unlike Section 179, there is no limit to the expenditure. Your shop’s biggest purchases will qualify.

The bonus depreciation percentages begin to drop after 2017. For purchases made in the 2018 tax year, your business can get 40% bonus depreciation on the cost of new equipment with no limit to the purchase price. That percentage drops to 30% in 2019 for any equipment purchased and placed into service before the end of the calendar year. It is expected that Congress will phase Bonus Depreciation out completely by 2020.

As always, check with your accountant and financial advisor to verify tax law for your manufacturing business. Here’s to a safe and productive 2016 for all in the manufacturing industry!